Efficient and liquid wholesale markets are a prerequisite for competitive retail markets, and hence an advantage for the final consumer. The larger supply and demand, the more relevant and competitive the price signal. Therefore, increasing the liquidity of the European market is a means to maximise social welfare for all European citizens.

Electricity - a unique commodity

Electricity is an essential good in our society. It not only provides us with light and warmth, but it is also a basic element of any industrial activity. The liberalisation of power markets in the 1990s was the starting point of the creation of an Internal European Energy market achieving security of supply, competitive prices and enhanced services to customers. Within this European Internal Energy Market, a large variety of companies organise the production, trading, marketing, transmission and supply of electricity; within the framework of appropriate regulation. Electricity is a particular commodity that cannot easily be stored. Moreover, the frequency on the electricity grid needs to remain stable at all times, meaning users of the transmission grids must be balanced in real-time between their resources and consumption of power.

This makes the short-term spot power market an essential tool to balance the overall system. And since the European spot power markets are coupled, they help to provide electricity where it is needed and when it is needed, even across borders.

Power Exchanges organise trading and operate markets

Power Exchanges offer a trading platform to their exchange members. The members connect to this platform and submit orders for buying and/or selling power, which are registered in an order book. These orders reflect supply and demand for a specific market area at a certain moment in time. Based on the order book, Power Exchanges calculate a market price (scroll down for more details on the price calculation). Since the trades result from a large, open and transparent competition between the orders of the Exchange members, they reflect the best information available at the time under the market conditions. They are hence the most reliable prices available for electricity in short-term delivery. By matching supply and demand, Power Exchanges ensure a transparent and reliable price formation, and they make sure that the traded electricity is delivered and paid.

Markets organised by Power Exchanges are optional, anonymous and accessible to all participants satisfying admission requirements. In opposition to direct bilateral transactions, called Over-the-Counter (OTC) trades, the organised market place operated by an Exchange has various advantages such as pooling of liquidity, transparency, emergence of a single reference price, payment and delivery security, anonymity and the application of Market Rules.

Electricity crosses borders, increasing social welfare

European Market Coupling, to which EPEX SPOT has been a major contributor, allows for electricity to flow freely across borders. Electricity is distributed more efficiently all over the continent, because flows follow price signals (see PCR). The efficiency of cross-border trading, therefore, has an impact on social welfare. EPEX SPOT provides such instruments in both the Day-Ahead and Intraday segments, via the European Single Day-Ahead and Single Intraday Coupling, ensuring transparent and secure transactions in all our market areas.

Factsheet - What is a Power Exchange?

Clearing and Settlement

Once a trade is completed on the platform of an exchange, the transaction is cleared and settled. Clearing ensures the proper fulfilment of each contract concluded or registered on the exchange. In its position as the central counterparty, the clearing house steps in after a trade has been concluded, becoming the contractual partner for both buyer and seller. In doing so the clearing house ensures the fulfilment of each trade (payment and delivery) and mitigates the counterparty risk.

All transactions on EPEX SPOT are cleared and settled by ECC, the leading clearing house for energy and commodity products in Europe. ECC conducts all payment flows between the seller and the buyer (financial settlement) and guarantees the delivery of the traded electricity (physical settlement).

As a clearing house specialising in physical commodity markets, ECC works together with a network of Transmission System Operators (TSOs) and registries, supporting various market coupling projects for connecting the European energy markets.

Day-Ahead and Intraday – the backbone of the European spot market

EPEX SPOT operates the most liquid Day-Ahead and Intraday markets in Europe. Both markets fulfil different purposes and are indispensable links of the energy value chain.

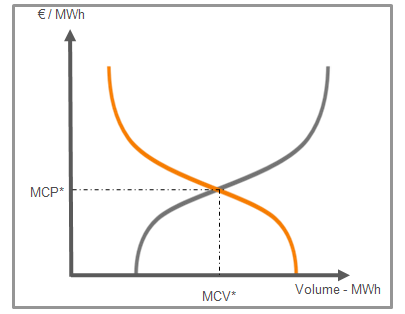

The Day-Ahead market is operated through a blind auction which takes place once a day, all year round. All hours of the following day are traded in this auction. The orders are logged in by the market participants before the order book closes at 12:00 CET (10:20 for Great Britain and 11:00 for Switzerland). Then the algorithm is launched. Market participants send two types of orders in the auction: Firstly, orders for each delivery period that reflect their willingness to buy or sell, in volume, for all price ticks between the minimum and maximum prices of the auction. Secondly, block orders linking several delivery periods together. Based on the buy-orders, the Power Exchange establishes a demand curve, based on the sell-orders it establishes a supply curve, referred to as aggregated curves, both for each hour of the following day. The market clearing price (MCP), which reflects supply and demand, lies at the intersection of both curves.

As a result of this order matching, the Power Exchange determines trades which are legally binding agreements to purchase or sell a determined quantity of electricity to a defined delivery area for the matched (or “cleared”) price. There is one price, the market clearing price or MCP, that is determined for each delivery period and that applies to all buyers and sellers. This price is never higher than the purchase price fixed by the buyer or lower than the sale price offered by the seller. All buyers who submitted volumes at a price higher than the MCP are executed for these volumes and pay the MCP, and all sellers who submitted volumes priced lower than the MCP are executed for these volumes and receive the MCP. In the auction, buyers and sellers are not matched one-to-one. There is an overall executed buy volume that is equal to an overall executed sell volume for each delivery period.An auction has the advantage of gathering liquidity at one point in time while offering full transparency on the traded Market Clearing Volumes (MCV) and creating a level playing field. Exchange members use the auction to sell and buy the largest part of the produced/ needed electricity.

The EPEX SPOT Day-Ahead auction is integrated into the Single Day-Ahead Coupling (SDAC) which encompasses 27 countries across Europe, excluding Great Britain and Switzerland.

The Intraday market offers the possibility to trade even more in the short term. Market participants can either trade continuously, on the Intraday continuous market, or via Intraday auctions. On the Intraday continuous market, participants trade 24 hours a day, with delivery on the same day. As soon as a buy- and sell-order match, the trade is executed. Electricity can be traded up to 0 minutes before delivery and through hourly, half-hourly or quarter-hourly contracts. As this allows for a high level of flexibility, members use the Intraday market to make last minute adjustments and to balance their positions closer to real time. Cross-border trading is essential in Intraday trading, and European Intraday markets are connected via the Single Intraday Coupling (SIDC). Intraday auctions are also available on the Intraday market, they allow for a pooling of liquidity at a certain point in time and deliver a price reference for electricity delivery on the same or on the following day, depending on the auction timing.

The pan-European Single Intraday Coupling encompasses 25 countries, excluding Great Britain and Switzerland.

Merit order and marginal cost - the price formation process

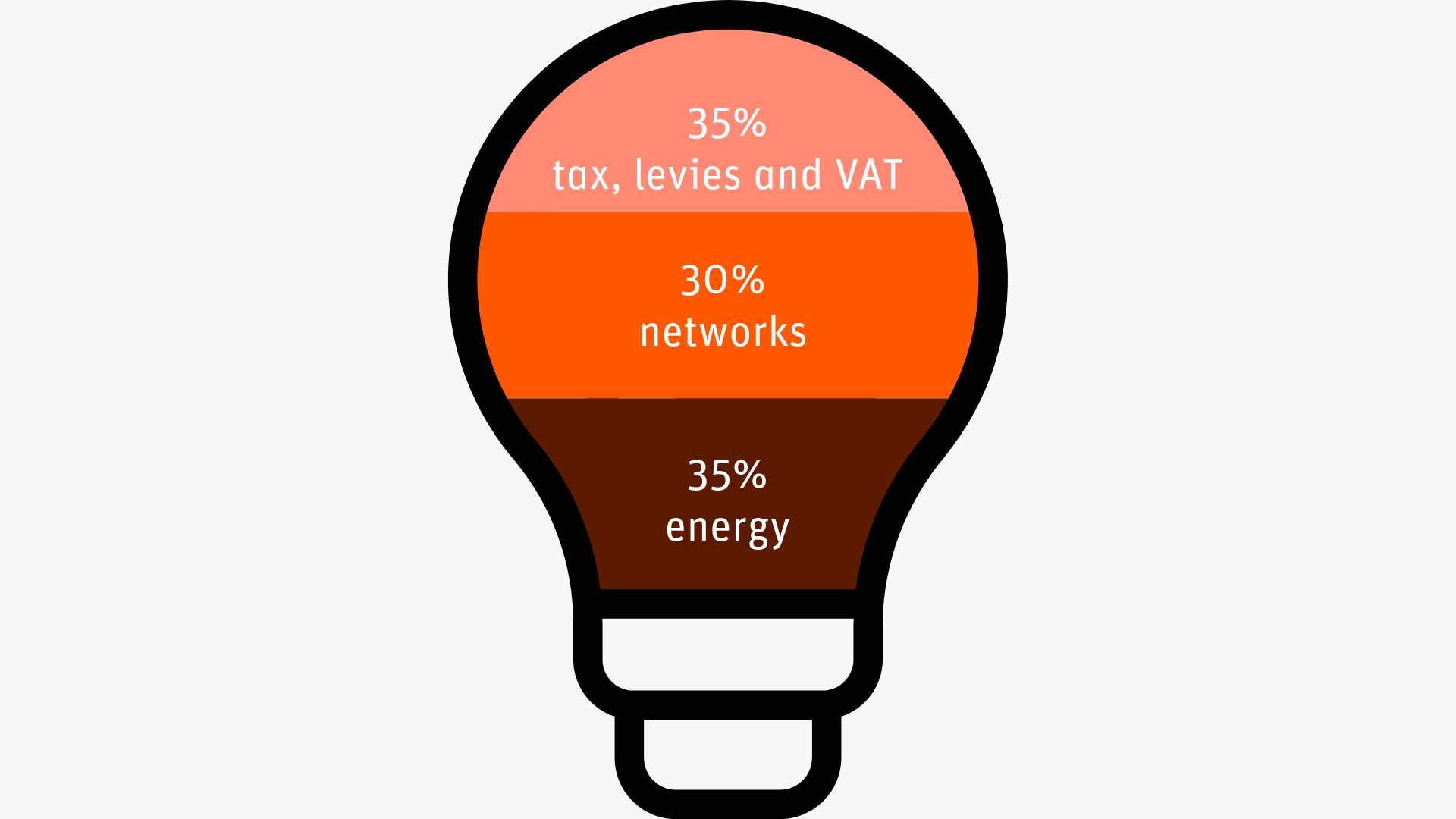

The electricity bills of any European end-consumer consist of many components that vary between countries. One component is always the price for power. This price for power is based on prices on the wholesale spot electricity markets, which are operated by EPEX SPOT. The wholesale power market brings together producers that sell electricity, and suppliers that buy electricity, to then have it delivered to their customers.

Marginal cost and merit order

Price formation on the EU Day-Ahead spot power market is based on marginal cost, which indicates how much it costs a producer to generate one additional MWh of electricity. Power plants are put on the market by the order of their marginal production cost, starting with the least expensive up to the most expensive plant, activated in that order to meet demand. The last activated plant sets the price. All producers are paid the same price €/MWh for the same product: electricity.

The least expensive marginal production costs are usually renewables, the most expensive plants are gas and coal plants. In addition, the use of coal and gas generation in Europe needs to be covered by CO2 certificates, creating a direct connection between electricity pricing and CO2 pricing, as well as prices for coal and gas.

The marginal cost pricing system

- ensures that demand is always met at the lowest possible cost, because cheap producers are dispatched first.

- enables all generators to always cover their costs, ensuring security of supply. If producers know they can always cover they cost, then they have an incentive to run their units when they are needed.

- incentivises generators to offer their production at a price not higher than their actual operating costs. If they did offer electricity at a higher price than their true marginal cost, then they would risk not to sell at all, because orders of other producers who bid at their true marginal cost would be executed to meet demand.

The power market as a barometer

Unlike other commodities, electricity cannot be stored efficiently. This makes the electricity market an essential tool to balance the overall system and ensure that supply matches demand at all times. The Day-ahead and Intraday power markets operated by EPEX SPOT are physical markets. Unlike on financial markets, every single transaction on the power spot market leads to a physical delivery of electricity. The electricity price is determined by EPEX SPOT 24/7, and for the whole of Europe.

The electricity price surge we have been observing since Autumn 2021 has different causes, some of which are:

- High global gas demand as a consequence of the post-covid economic pickup

- Low supply, meaning low wind, lower-than-usual gas storage, hydro-reservoirs levels, and nuclear availability

- High CO2 prices, that drove up further the costs of ramping up conventional power plants.

The prices of the power market fully reflect these challenges that developed in the past two years. Instead of “breaking the barometer” by interfering in the price formation process, it is crucial to address the real causes of the price surge while taking measures to protect the vulnerable end-consumer.

The Wholesale Market and renewables

Initiated by the European Union’s 20/20/20 policyand driven by subsequent initiatives such as the Clean Energy Package or the EU Green Deal, renewable electricity capacity has increased significantly in the past 10 years. This growth, fuelled by political, economic and environmental imperatives, will see renewables continue to play an increasing role in the European energy mix over the next decade.

The European Commissioner for Energy declared in 2023 that, in order to stay on track to meet the Green Deal targets, the EU needs to triple its renewable deployment. Global installed renewable capacity has pushed through the 300 GW mark for the first time in 2022, according to the International Energy Agency. These trends pose challenges for energy markets due to the specific characteristics of renewable generation, notably intermittency and daily ramping increase and decrease.

Green power needs to be efficiently integrated into the wholesale market in order to reach the final consumer.

This means short term power trading needs to adapt to the specific characteristics of renewables. Over the past years, EPEX SPOT’s markets have demonstrated their suitability to integrate additional renewable volumes whilst minimising price impacts.

EPEX SPOT’s coupled Day-Ahead markets have proven to be a key tool for limiting the potential price impacts of renewable energy. By fully optimising the use of interconnectors, national surpluses and deficits are mitigated in the coupled markets, providing more resilience against supply and demand disturbances. Day to day or seasonal variations in renewable production can be counterbalanced between zones, and converging prices smooth both positive and negative peaks.

Besides Market Coupling, product granularity plays an important role in the integration of renewables. EPEX SPOT’s Intraday markets provide an effective solution for integrating intermittent supply, enabling producers and consumers to balance their positions close to real time. Electricity can be traded up to 0 minutes ahead of delivery, which provides a level of flexibility welcomed by market players who trade both renewable and conventional energy. On all markets, 15-minute and 30-minute contracts are available, providing greater flexibility to handle the daily ramping effects of renewable production and contributing to a more balanced market. The coupled markets of SIDC have fully switched to 15-minute products since January 2025. In addition to this, local and coupled Intraday auctions are available in all market areas. Since June 2024, coupled Intraday auctions are featured on all SIDC markets.

Dealing with high electricity prices

The market design is not to be blamed for high electricity prices, the price information is a message that signals tension in the electricity system of supply and demand. To reduce the occurrence of high electricity prices, decision- and policy-makers should focus on the following:

- To further integrate the European electricity market, as it is key for Europe’s energy security. This means offering new products – like Pan-European Intraday Auctions and developing further cross-border trading and flows. Europe’s power exchanges ensure the optimal use of all interconnections.

- To move away from fossil-fuelled generation by investing massively in renewables and flexibility sources and efficiently integrate these green energy sources in the market. Tailor-made trading solutions to achieve this already exist on all EPEX SPOT markets.

- To allow reliable and transparent price signals to emerge, to trigger investments in decarbonised technologies. Price signals should also help electricity consumers to adjust their consumption behaviour.

- To monitor measures such as a revenue cap on inframarginal technologies or a price cap on gas for bidding in the power market. Such measures do, theoretically, not directly impact the price formation process on the wholesale market, but if and how they have an indirect impact on the efficiency of the market highly depends on the details of their implementation.

- To protect vulnerable consumers – such measures are indispensable. They should, however, not undermine the efficiency of the wholesale market, because market distortion would in the end generate costs that would be passed on to the end-consumer. The European Commission has developed and implemented several proposals that provide relief for end-consumers, such as the REPower EU package

If governments suddenly change the rules on how prices are set, this would freeze all investments in renewable generation and as a consequence decrease security of supply. Furthermore, consumers should have sufficient information to choose their preferred level of risk exposure and be enabled to cover this risk.

The pan-European electricity market is the most efficient one in the world build up over more than 20 years and it acts as a model for other regions. EPEX SPOT is contributing to the well-functioning of the market and facilitates the energy transition by continuously working on innovations.

More Information

You can find more information on the characteristics and challenges of the European electricity market in our Factsheets.

High electricity prices - Q&A

-

Do high prices mean the market is failing?

The market is not failing. It reflects the fundamentals of demand and supply as accurately as possible. In these times of turbulence, the market is providing strong price signals. The move away from fossil fuels has become even more pressing in the recent geo-political context.

Transparent and reliable price signals that correctly reflect market fundamentals are the best tool to trigger efficient production and consumption decisions and to drive investments in the right generation capacities. Measures to regulate or structure the market would not preserve this investment signal but distort it, necessarily leading to a standstill of the much needed transition. -

What is the merit order and why is it important?

The price formation process on the pan-European Day-Ahead market follows the merit order principle. This principle guarantees the lowest possible prices to satisfy demand on the power market, as the generation with the lowest costs (or the willingness to sell at the lowest price, to be more precise) is dispatched first.

According to the merit order principle, the most expensive unit that has to be activated to meet the demand sets the price. In turn, this also means that the cheapest units, often wind and solar, are dispatched first.

The actual market price is where the supply of power matches demand. In the Day-Ahead market, which also produces the settlement price for the derivatives markets, a uniform price is determined where the curves for supply and demand intersect, at a total volume that is derived from the optimisation of overall social welfare. Among the successful orders, this price represents the highest price that a buyer is willing to pay and the lowest price a seller is willing to accept. This allows generators that are able to produce at lower prices to recover their investment costs. When criticising high prices, one should also consider that they deliver investment signals, promote energy efficiency, and that they make additional public support unnecessary.

-

Should the gas and electricity prices be "decoupled"?

The question should rather be if they are truly coupled, and when? Only when demand cannot be met with the cheapest production methods, the higher priced units such as gas-fired units are activated. This means that there is no compulsory link between the electricity and the gas price. Gas units only set the electricity price in certain times, i.e., in hours, when all cheaper production units have been fully exploited. With more renewable generation able to satisfy demand, the expensive gas units would have to be activated later – or not at all.

-

Why is marginal pricing important for the energy transition? Should we abandon it because of the crisis?

The least expensive unit in terms of marginal costs are usually renewables, the most expensive plants are gas and coal plants. However, the initial investment and maintenance costs for renewable plants are rather high, while the investments and maintenance costs for coal and gas plants are one-time and rather constant. This is why it is important that also generators with low marginal costs like renewables can recover their investment costs.

The marginal cost pricing system enables all generators to cover their costs, ensuring security of supply, while incentivising generators to offer their production at a price not higher than their actual operating costs.

Only by reducing our dependence on fossil fuels, we can secure supply at reasonable prices for Europeans. Especially in a situation of scarce supply, the price formation mechanism has an essential function of information and coordination. It can reveal more efficiently than any other mechanism which use of the scarce resource energy has highest economic value. To deliberately discard or modify this information would be a huge loss.

-

Are we paying also for the energy bills of our European neighbors?

The integration of European markets (Market Coupling) creates net benefits for European consumers. It optimises the use of energy resources across borders and increases security of supply. In 2021 the European Union Agency for the Cooperation of Energy Regulators (ACER) estimated the annual social welfare benefit for market coupling up to 34 billion EUR/year, which illustrates its importance.

-

Why are electricity prices volatile at times?

In addition to the high prices, the electricity market has seen increased price volatility, which is an indicator for the need for more flexibility in the system. Flexibility is the capacity of actors to ramp up or down their demand or their supply.

Further flexibility in the system can be enabled in the form of even closer interconnection between the already well connected markets. It can also be in the form of incentives for certain established technologies, such as battery storage or demand-response units that can flexibly ramp up and down their production and consumption. With the right price signals, we can ensure that the flexibility is used in an efficient manner and that providers are remunerated.

-

Is the Iberian model a better option to regulate the electricity price? Shouldn’t we just extend this model to the whole of Europe?

The so-called Iberian model is a modification of the power market design that is specific to the Iberian Peninsula. It has been in place since June 2022 and mainly consist of a €40 MW/h cap on gas used for power generation, gradually increasing every month This cap has lowered electricity prices in Spain and Portugal, but only by 15%. In addition to this, gas usage is higher than before the crisis. The payments made to gas-fired production units to make up for the difference between the real gas price and the artificially capped gas price are financed by the end-consumer.

Could such a cap make sense across Europe? The answer is no. Especially if applied only by few EU Member States, this cap would distort cross-border flows of electricity, putting at risk security of supply and the optimisation of the European electricity system. Through Market Coupling, low supply in one country raises the power price, attracting power flows from the neighbours. A price cap would hide such supply shortage signal by making prices artificially lower. This artificially cheap European power would then mechanically be exported and flow to neighbouring countries, aggravating the supply shortage in Europe. In addition, the cap would burden taxpayers’ finances.

The same would happen if this mechanism was to be extended to the whole of Europe. The gas scarcity wouldn’t go away but it would be made worse because more artificially cheap- gas would be used than the produced electricity, which in the end would be exported to higher-priced regions outside of Europe.

A measure like this disrupts the meaningful price signal and Market Coupling mechanism at a European level and endangers the decarbonisation path not only in Iberia peninsula, but in the whole European market.

-

Should we change our pricing model from pay-as-clear to pay-as-bid?

Today, the price formation mechanism in the European Day-Ahead auction follows a pay-as-clear model based on marginal pricing. Via this mechanism, the cheapest generation capacities are always activated first (in the so-called “power generation merit curve”), ensuring demand is always met at the lowest possible cost. Power plants are put on the market by the order of their marginal production cost, starting with the least expensive up to the most expensive plant, and activated in that order to meet demand. The last activated plant sets the price. All producers are paid the same price €/MWh for the same product: electricity. Everybody receives the so-called Market Clearing Price in this pay-as-clear model.

This mechanism gives investment signals in new clean technologies and allows power generators to cover their costs, eventually ensuring security of supply.

An alternative market setup, as implemented on the Intraday continuous market (an adjustment market complementing the Day-Ahead reference market), is ‘pay-as-bid’. This means that sellers submit bids and as soon as a buyer accepts, the transaction is executed. The market reference price would then be seen as an “average bidding price” set by the market participant, as opposed to the marginal price set by generation costs.

If the pay-as-bid mechanism was applied in the Day-Ahead market, market participants would try to anticipate the market clearing price and bid above their marginal costs in order to maximize their profits. Hence, the power generation units activation priority would be based on the traders’ ability to best forecast the market price, instead of on their economic and environmental efficiency. This is why a shift from marginal pricing would generate negative consequences but not lower energy prices.

Negative Prices - Q&A

-

What are negative prices and why do they occur?

Negative power spot prices occur when there is an excess of production compared to consumption. These prices signal the need to decrease production and/or increase consumption. Negative prices appear with a high amount of renewables feed-in, low consumption and a high inflexible power generation. Inflexible power sources such as lignite or nuclear plants can’t be shut down and restarted. Renewables support schemes also impact the occurrence of negative prices. Although renewable production has zero marginal cost, in case of a support scheme such as market premium, premium producers are incentivised to maintain the production unless the price goes below the premium.

On wholesale markets, electricity prices are driven by supply and demand, which in turn are determined by several factors such as- climate conditions (e.g. temperature levels during different seasons),

- seasonal factors (e.g. bank holidays or major events) or

- consumption behaviour (e.g. weekday vs. weekends).

Prices fall with high production and low demand, signalling generators to reduce output to avoid overloading the grid. On all Day-Ahead and all Intraday markets of EPEX SPOT, electricity prices can fall below zero.

In some circumstances, negative prices allow the power system to deal with a sudden oversupply of energy and to send appropriate market signals to reduce production or increase consumption. In this case, thermal producers have to compare their costs of stopping and restarting their plants with the costs of selling their energy at a negative price (which means paying instead of receiving money). If their production means are flexible enough, they will stop producing for this period of time which will prevent or buffer the negative price on the wholesale market and ease the tension on the grid. Renewable generators have similar incentives in case they don't receive a subsidy scheme (i.e. a feed-in-tariff or a premium when they produce).

-

Are negative prices a theoretical concept or is the buyer really paid for buying electricity?

Negative prices are not a theoretical concept. Buyers are actually receiving payments and electricity from sellers. However, one needs to keep in mind that if a producer is willing to accept negative prices, this means it is less expensive for him to keep their power plants online than to shut them down and restart them later.

-

How often do they occur?

Negative prices are a comparably rare phenomenon, as several factors have to happen at the same time. In Germany, where inflexible power generation from renewables is increasing, 459 hours with negative prices were observed on the Day-Ahead market in 2024, 301 hours in 2023 and 69 hours in 2022. This means 5% of the hours in 2024 were negative, 3% in 2023 and 0.8% in 2022. In the Netherlands, 465 hours recorded negative prices on the Day-Ahead market in 2024, 316 hours in 2023 and 85 hours were negative in 2022. If these markets were not coupled, negative prices would occur more often, and price peaks would be more acute.

For more insights into historical market data and occurrence of negative prices, please send an email to marketdata.sales@epexspot.com

-

Aren’t negative prices threatening producers' businesses?

Negative prices are a signal, an indicator for market participants. If producers decide to keep their production up, they have calculated that this is the best, most cost-efficient way for them considering the costs of shutting down and restarting their plants or for renewables considering their support scheme. If negative prices become too numerous, they could challenge the business case of future production assets, but they could also make a case for consumption units or storage assets.

-

Are negative power spot prices unfavourable to renewable assets and therefore block green investment?

Negative prices signal that there is too much production. If renewables are integrated in the market and not based on subsidy schemes investors will avoid over-investing and production (thermal or nuclear) and this limits the occurrence of negative prices. If the power market sees periods with negative prices, it will ultimately adjust with storage and flexibility solutions. Negative prices create incentives to innovate and find new solutions to deal with the inflexibility of the power system, for instance investments in batteries, or new ways to take up excess production, such as green hydrogen production.

-

Are there any means to soften or prevent negative prices?

Support schemes for renewables need to be phased out to avoid over-investment and situations of oversupply that favour negative prices. Furthermore, the general framework should facilitate the ability of consumers to benefit more from negative prices and increase their consumption during these negative price events. Dynamic price tariffs and smart meters contribute to this.

Liquidity – based on wide offer and demand – is key for lowering the occurrence of negative prices. This is where cross-border trading solutions come in. On the Day-Ahead market, Market Coupling provides a solution for the optimal use of cross-border capacities between two or more markets. Thanks to the pan-European Single Day-Ahead Coupling, negative prices are buffered or prevented. For instance, in the case of low or negative prices in Germany, France and Benelux, Denmark and Sweden will import electricity until the cross-border capacity is fully used or prices converge. The Single Intraday Coupling works according to the same principle.

In addition, especially in the context of the energy transition, flexibility solutions become key. Additional assets that can ramp up or down their electricity consumption, such as battery storage, data centres or electric vehicles, have to play a more active role in balancing out the electricity system? This can be done, for instance, via Local Flexibility markets, such as the one developed by EPEX SPOT in the UK or in the Netherlands.

-

Should governments stop negative power spot prices from happening? Is it the fault of the merit-order?

No. Negative prices, as any prices on the electricity wholesale market, carry precious information on the balance of supply and demand in the power system. This creates incentives to optimise the power system through investments. For instance, if prices are high, this is an incentive to lower consumption and invest in additional production assets. If prices are low, this incentivises a more flexible power generation and consumption, where new solutions will be developed. Intervening in the price formation would send a distorted price signal, preventing the development of solutions while the underlying reality of the power system remains unchanged.

The merit-order principle that is applied on the power market ensures that demand is always met at the lowest possible cost for the society. On the coupled pan-European Day-Ahead markets, a daily auction takes place, and all sellers are paid the same market clearing price. During some hours, cheaper renewable production sets the price; during other hours, more expensive production assets set the price. During these higher-priced hours, renewable producers are still paid the market price, and the difference to their marginal cost allows them to refinance their assets.

-

Since when do negative power spot prices exist?

Negative prices were first introduced in 2008 on the German/Austrian Day-Ahead and 2007 in the German Intraday market. In 2010, they were also introduced on the French Day-Ahead and Intraday markets. Today, the common processes of the Single Day-Ahead Coupling and Single Intraday Coupling foresee negative clearing prices for the Market Coupling session.

-

Are there limits for negative prices? If so, why?

Yes. There are price caps that are reached extremely rarely. They are an economically logical technical limit for power trading. On the coupled Day-Ahead markets, the harmonised minimum clearing price is -500€/MWh. On the coupled Intraday continuous markets, it is -9999 €/MWh. The harmonised maximum and minimum prices applied by all Power Exchanges that are part of the pan-European Market Coupling follow a shared methodology that is also validated by ACER (the European Union Agency for the Cooperation of Energy Regulators) and National Regulatory Authorities.