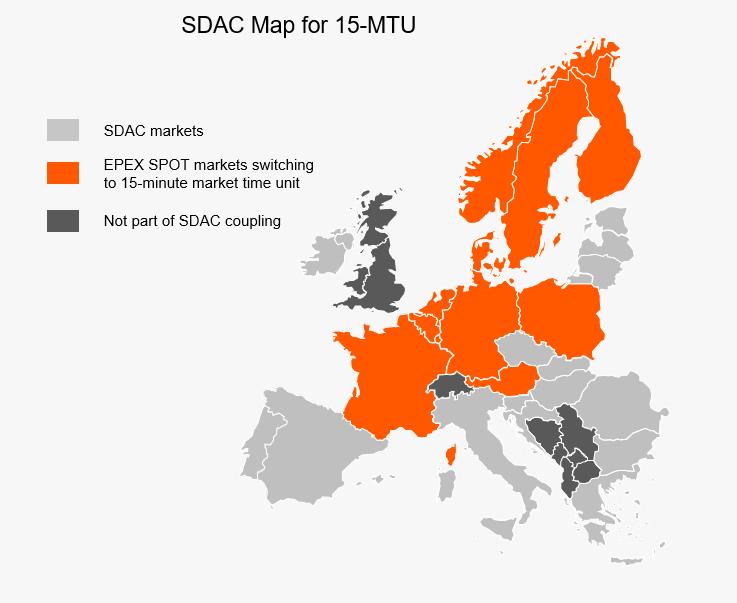

In accordance with the legal framework developed by the European Commission, all TSOs in all EU Member States are required to employ a 15-minute time resolution for imbalance settlement, resulting in an obligation for all NEMOs to offer 15-minute products for trading on all SIDC and SDAC coupled markets. This harmonization aims at creating consistency across European energy markets (as some TSOs already apply a 15-minute imbalance settlement period) and enhance efficiency in electricity balancing processes.

A 15-minute time resolution is expected to facilitate better integration of renewables, as their production varies within an hour, and to improve grid stability. It also facilitates better forecasting of consumption behaviors.

All information stemming from the Market Coupling Steering Committee (MCSC) in relation to the go-live of 15-minute contracts in SDAC and SIDC is published on the website of the All NEMO Committee here .

The following methodologies and documents related to 15' MTU were published by NEMOs:

| SDAC Product Methodology | https://www.nemo-committee.eu/publication-detail/day-ahead-product-methodology |

| Algorithm Methodology | https://www.nemo-committee.eu/publication-detail/algorithm-methodology |

| SDAC and SIDC IDAs algorithm description | https://www.nemo-committee.eu/assets/files/euphemia-public-description.pdf |